Forex Money Management

Learn to control risks in trade 📊 Forex smart money management

Forex Money ManagementLearn to control risks in trade 📊 Forex smart money management |  |

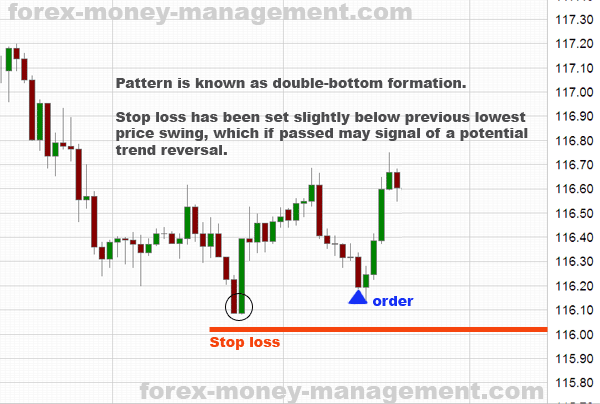

Learn to use Stop Loss effectivelyStill unsure whether you need it?Every day hundreds of Forex traders blame themselves for being so naive and trading without protective stops. Hundreds of others lose funds worth weeks, months & even years of trading just only in one very unsuccessful trade. And yet another hundreds of traders, having heard dozens of times about importance of protective stops, open new trades ignoring the well known money management rules. Stop loss isn't often a favorite tool for many Forex traders as it requires taking necessary losses, calculate risks and foresee price reversals. However, a Stop loss tool in hands of a knowledgeable trader becomes rather a powerful trading weapon than a cause of disappointment and painful losses. Every trader is free to develop his / her own trading style and implement own money management rules. We will go over several methods of using Stop losses. 1. Simple equity StopIt's an important money management rule: not to risk more than 2-3% of the total account per trade. According to this rule, a trader would place an order and based on a lot size would calculate amount of pips required to reach the limit of 2-3% of the total account balance (and a stop loss will be placed at that point). For example: a trader has $1000 USD account, he places a buy order of 4000 units on EUR/USD, which will give him on average $0.40 cents per 1 pip. Since 2% risk that he is willing take equals $20 USD ($1000 * 2%), Learn more about risks and effective money management on our main page: 2. Chart based StopUsed by many traders, this stop relies on different chart patterns, indicators and signals received when analyzing the market. There are many styles & techniques associated with different Forex trading systems. Examples of some of them can be found at TrendLineBook.com and FibonacciBook.com.There are several approaches to placing protective stops: Let's take a look at some examples below: A stop loss based on the last swing low (double-bottom pattern)

Chart based stops are widely used in combination with simple equity stops.

| |||||||||||||||||||||

READ NEXT ↷

Forex trading is a high risk investment. All materials are published for educational purposes only. |